Life Insurance

You may be considering the best way to secure your family’s future. Making sure your income is protected in the event of your death is a great place to start.

Get a quote

I understand and agree that, by submitting my information, a licensed insurance broker will contact me to provide additional information about the health insurance plans available in my local area.

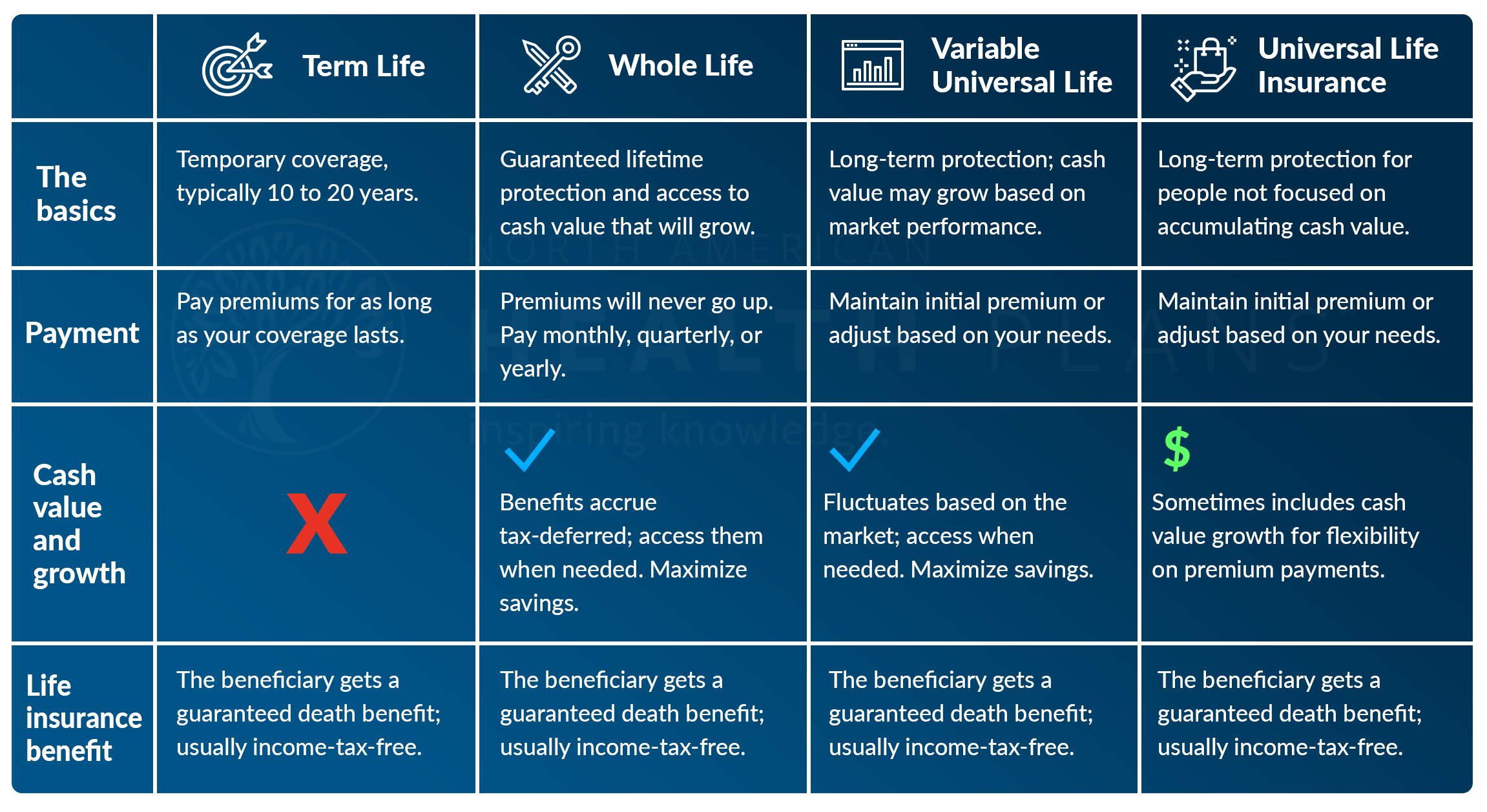

Life insurance can help with that, and there are some different options that you can pick from — depending on your needs. Let’s look at the options:

Who Should Consider Term Life Insurance?

Term life insurance gives you guaranteed protection now that can also help you prepare for the future. You can choose how long you want to be covered. And, in most cases, you can convert your policy into long-term coverage later. As we get older, our lives may change. But the important thing to know is that term life can help you reach your goals at every stage of your life.

- You have young children.

- You need coverage for a set time.

- You want to balance immediate needs with continuous goals.

- You want predictable payments.

Who Should Consider Whole Life Insurance?

Whole life insurance is more expensive than term life, but it can be the right choice for the right person. It gives you permanent protection with added benefits, including access to cash value when needed. You can structure your policy and choose how quickly your cash value grows.

- You’re looking to balance cash value accumulation and guaranteed coverage.

- You want rider features customized to fit your needs.

- You’d like to customize your premiums.

Build a Solution Geared Towards Your Needs

Now that you’re familiar with the options and understand how they work, you can arrange a strategy tailored to the needs of your family. It can be helpful to talk with a life insurance advisor about the various ways to combine features and protect your loved ones. With our expert guidance, you can make informed decisions on the type of policy, carrier, and coverage amount that works for you. Contact us today!