Get More Coverage to Help Protect Your Health

If you don’t have something besides Original Medicare (Parts A and B), you will be taking a big financial risk. Original Medicare has limited coverage, no maximum out-of-pocket limit, and does not provide benefits for dental, hearing aids, or retail prescription drugs.

To get more healthcare coverage, you can join a Medicare Advantage (Medicare Part C) plan.

Have Us Contact You.

I understand and agree that, by submitting my information, a licensed insurance broker will contact me to provide additional information about the health insurance plans available in my local area.

What Is Medicare Advantage?

Medicare Advantage is an all-in-one version of Medicare that is offered by private insurance companies. The plans provide beneficiaries with their Part A (hospital), Part B (medical), and Part D (prescription) benefits to replace Original Medicare. If you enroll in an Advantage plan, your doctors will directly bill the plan.

Many plans offer additional benefits, such as:

- Wellness programs

- Dental

- Vision

- Hearing

- Prescription drug coverage

These plans are similar to traditional health insurance plans that you may be used to. They include a network of providers and facilities you can receive treatment from. You share costs until you reach your out-of-pocket maximum.

Note: You may face higher costs if you don’t stay in the plan’s network.

Types of Medicare Advantage Plans

Many Medicare Advantage plans are available for a low or $0 monthly premium. The most common types are HMOs, PPOs, and PFFS plans.

These plans allow you to only see doctors or specialists who are in their network (except in emergencies). When you want to see a specialist in an HMO, you must get a referral from your primary care provider (PCP).

With a Medicare Advantage PPO plan, you don’t need a referral to see a specialist. You can see any provider, although out-of-network providers will cost a lot more.

Note: Check with your doctors to find out if they participate in the network for the plan you’re considering.

A PFFS plan decides how much it will pay doctors, hospitals, and other health care providers, and how much you have to pay when you receive care.

If you join a Medicare PFFS plan that has a contracted provider network, you can see any of these providers who have agreed to treat you. Similar to a PPO plan, going out-of-network for non-emergency or non-urgent care services will result in higher costs, or your plan not helping at all.

Medicare Advantage Enrollment Periods

You can join an Advantage plan when you first become eligible for Medicare, during the 3 months before and after your 65th birthday month—known as your Initial Enrollment Period.

Thereafter, you may only join or drop Medicare Advantage plans at select times of the year. The Annual Enrollment/Election Period for these programs is every fall, from October 15th through December 7th.

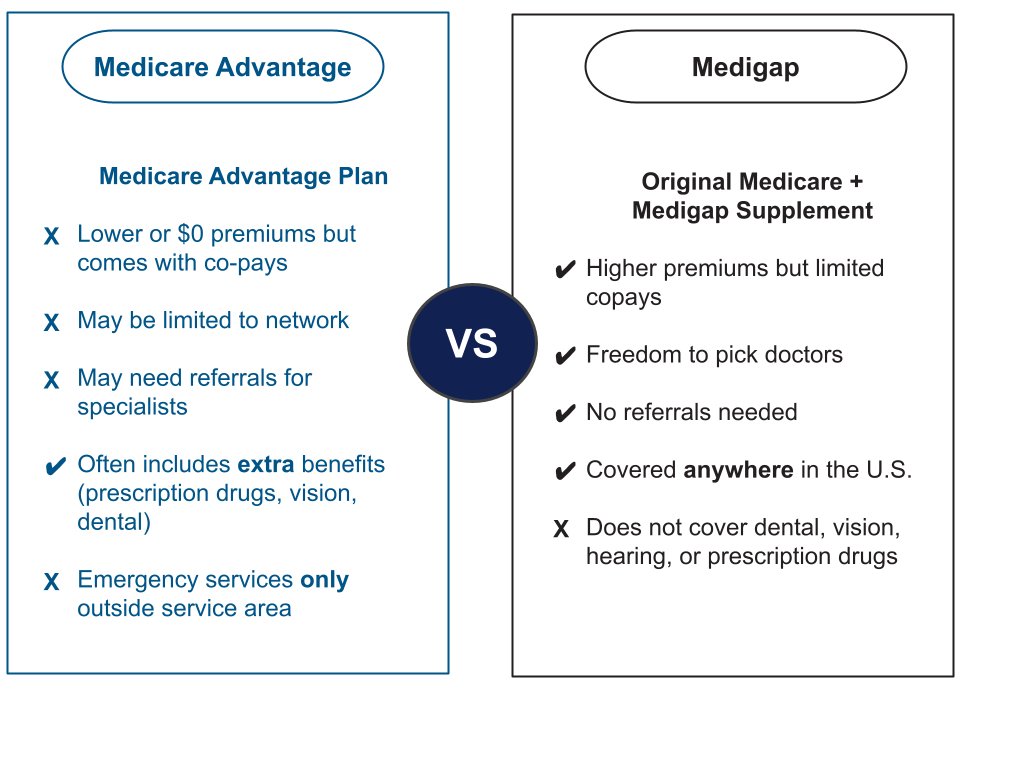

Medicare Advantage vs. Medicare Supplements

Medicare Advantage is not the same as Medicare Supplement (Medigap) insurance.

It’s important to know that you can’t have both. When you age into Medicare, you can select the option that works best for you.